tax incentives for electric cars in texas

In addition to local incentives the federal rebate for electric cars applies to all fifty states. These are only the basic rules.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Liquefied petroleum gas LPG.

. Credit amount depends on the cars battery capacity and automaker. President Bidens EV tax credit builds on top of the existing federal EV incentive. Incentives are personalized for where you live.

Included are EVSE tax credits and Level 2 EV charging rebates as well as rebates for electric cars. Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. The Light-Duty Motor Vehicle Purchase or Lease Incentive Program LDPLIP provides rebates statewide to persons who purchase or lease an eligible new light-duty motor vehicle powered by compressed natural gas CNG liquefied petroleum gas LPG or hydrogen fuel cell or other electric drive plug-in or plug-in hybrid.

Incentives - Austin Energy EV Buyers Guide Electric Vehicle Incentives You may be eligible for a range of incentives including rebates tax credits and various other benefits. Electric vehicles are eligible for up to a 7500 tax credit with a few caveats. We cant rely on gas taxes forever but theres no simple obvious way to integrate electric vehicles and other alternative-fuel vehicles into.

The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax research analyst at HR Blocks Tax. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The State of Texas offers a 2500 rebate for buying an electric car.

There may be additional incentives provided by your state. The amount of the credit will vary depending on the capacity of the battery used to power the car. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

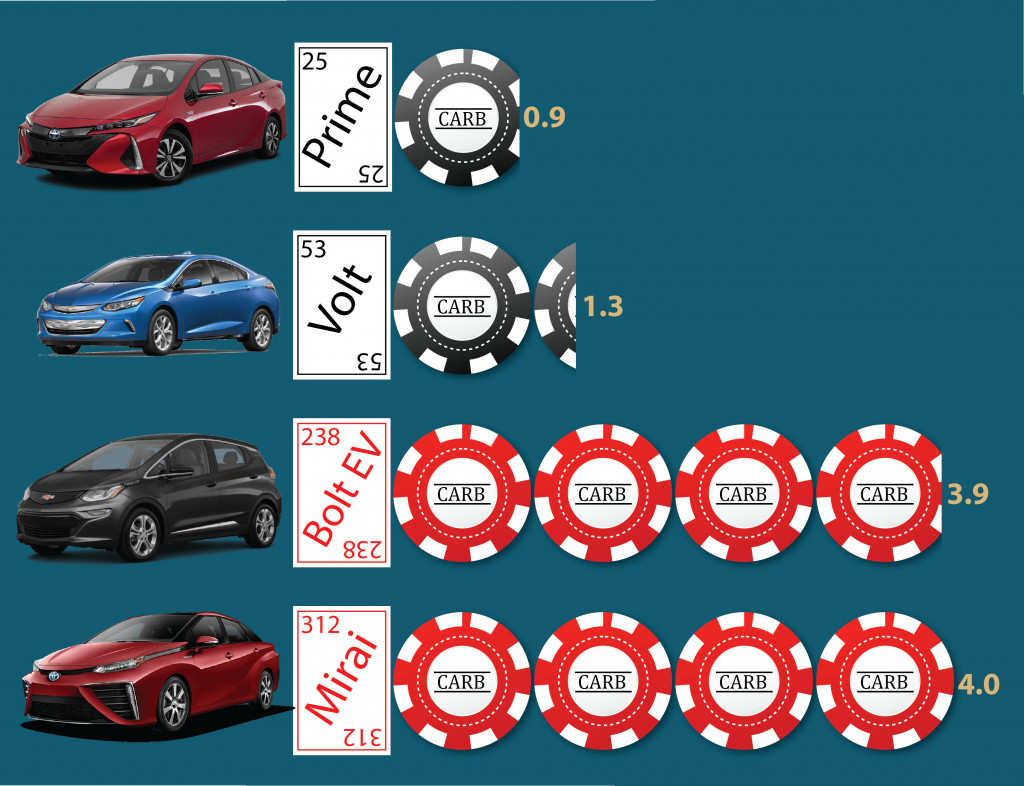

Federal Tax Credit 200000 vehicles per manufacturer. Senator Joe Manchin told reporters that the additional union-built EV tax credit has been removed from ongoing discussions over the future of the federal electric vehicle tax credit. The Texas Light-Duty Motor Vehicle Purchase or Lease Incentive Program allows battery-electric and plug-in hybrid vehicle buyers to get a maximum 2500 rebate for a purchase or lease term of at least three-years and a minimum 83250 rebate for a one- to two-year note.

The Texas Department of Transportation has estimated that each electric vehicle that replaces a gas-powered vehicle could on average result in a 100 annual loss in state highway fund revenue. The Texas Commission on Environmental Quality TCEQ administers the Light-Duty Motor Vehicle Purchase or Lease Incentive Program for the purchase or lease of a new light-duty vehicle powered by compressed natural gas CNG propane hydrogen or electricity. In 2014 Texas lawmakers enacted a program to help promote the sale of EVs in Texas authorizing a 2500 incentive on the purchase of new EVs in the TCEQs Texas Emissions Reduction Plan.

Through the statewide Light-Duty Motor Vehicle Purchase or Lease Incentive Program LDPLI you might be eligible for a grant rebate of up to 2500 if you buy or lease a new qualifying alternative fuel vehicle that runs on one of the following. Electric Vehicle EV Rebate Denton Municipal Electric DME added 3112022 Electric Vehicle EV Charging Station Rebate Southwestern Electric Power Company SWEPCO Electric Equipment and Electric Vehicle EV Charging Station Incentive - Entergy Electric Vehicle EV Charging Station Incentive - Austin Energy. Texas is bringing back its electric vehicle incentive program which offers a 2500 discount at the purchase of all-electric plug-in.

Market then phase-out occurs. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

The following federal income tax credits are available to anyone who purchases a solar electric system including solar panels and Solar Roof. Energy storage paired with solar systems are considered qualified expenditures eligible for the tax credit. Approximately 90 of the energy consumed from transportation in the US comes from petroleum.

The vehicle must be new. And have a gross weight of less than 14000 pounds. The US Federal tax credit is up to 7500 for an buying electric car.

Depending on where you live tax credits rebates vouchers discounts on vehicle registration fees and other special offers or exemptions are available to support the EV movement. You must be the original owner. To get the full credit the vehicle must be within the first 200000 of that automakers electric vehicles produced in the US.

Drivers in Texas who purchase or lease an electric vehicle are eligible for rebates up to 5000 through the Light-Duty Motor Vehicle Purchase or Lease Incentive Program. If you want more information about the federal plug-in electric vehicle tax break contact us. Smith said thats why the 200 annual fee proposed by lawmakers this year sounded like an effort to penalize drivers of electric vehicles.

It looks like there will be no 12500 tax credit after all. State and municipal tax breaks may also be available. Compressed natural gas CNG.

With government EV incentives like the federal electric vehicle income tax credit you may even qualify for up to 7500 back depending on the make and model you buy. An eligible vehicle must be used predominantly in the US. 5th 2018 1225 pm PT.

Learn More Up to 1000 Alternative Fuel Infrastructure Tax Credit Tax credit for purchase of qualified charging equipment prior to Dec 312021. Texas EV Rebate Program 2000 applications accepted per year. If you have any questions read our FAQ section.

From May 2014 through June 8 2015 the state granted rebates totaling 34 million for just over 1700 clean-energy vehicles. Incentives in Texas Up to 7500 Federal Tax Credit Tax credit for the purchase of a new plug-in hybrid or all-electric vehicle. It must be purchased in or after 2010.

Electric Car Tax Incentives And Rebates Reliant Energy

Democrats Walk Tightrope In Push For Electric Vehicles The Hill

These Are The Best Worst States To Own An Electric Vehicle

Tcn Electric Vehicle Infrastructure Bill Fizzles As Evs Shift Into High Gear

Delorean Gets More Tax Incentives To Develop Electric Vehicle

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Does Texas Give A Tax Credit For Hybrid Cars North Freeway Hyundai

Why Texas 2 500 Electric Car Incentive Won T Apply If You Buy A Tesla

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

Why Are So Many Electric Cars Still Only Sold In California

Latest On Tesla Ev Tax Credit July 2022

How Electric Vehicle Tax Credits Work

:watermark(cdn.texastribune.org/media/watermarks/2010.png,-0,30,0)/static.texastribune.org/media/images/volt.jpg)

With Subsidies Electric Cars Gaining Foothold In Texas The Texas Tribune

Electric Vehicle Tax Credits What You Need To Know Edmunds

Benefits Of An Electric Car Buy A Used Ev Near Alamo Tx

Us Electric Car Prices Cheapest To Most Expensive Feb 7 2022

Hurry Texas Rebate For Electric Vehicles Expires Jan 7 Greensource Dfw